What are beneficial owners?

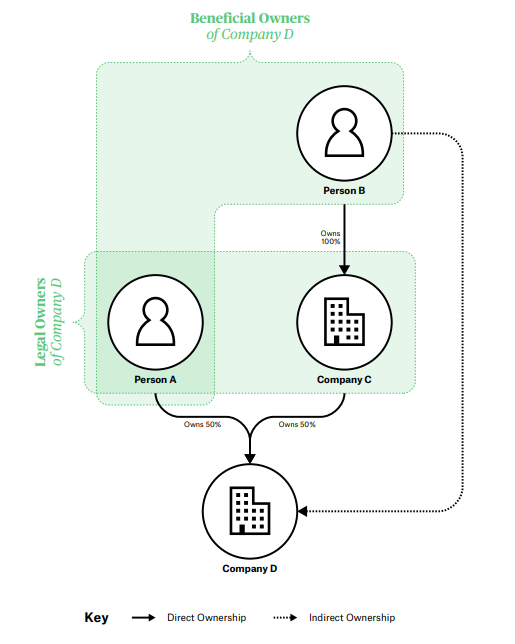

A beneficial owner, sometimes called an ultimate beneficial owner, or UBO, is how we describe the real, human owners of corporate vehicles (such as companies). They are the people who can benefit from its operations and profits, or control its activities: the people at the top of the ownership chain.

A beneficial owner is a person who ultimately has the right to some share of a corporate entity’s income or assets, or the ability to control its activities. Often, the ownership structure of companies and other corporate vehicles, like trusts, can be complex and opaque. This means that the individuals who own, control, or benefit from corporate vehicles can remain hidden.

If the beneficial owners are hidden, then governments don’t know who is bidding for a contract, companies don’t know who they are doing business with, society doesn’t know who is financing a new political party, and law enforcement can’t fight money laundering and other cross-border financial crimes.

Corporate ownership: Rights and responsibilities

Owning or controlling a corporate entity comes with rights, such as limiting liability, as well as responsibilities to customers, shareholders, governments, regulators, and other businesses. Knowing the beneficial owner of a company helps identify where decisions are made and who should be held accountable.

Beneficial ownership differs from legal ownership. Companies can own or control other companies, and in this case they are known as legal persons.

Shell companies

Companies that only exist on paper, and that do not have any real operations or employees, are sometimes referred to as shell companies. Creating a shell company in a jurisdiction without company ownership disclosure requirements and transferring stolen assets to this company makes it difficult to follow the money between the stolen assets and their anonymous owners.

Shell companies in these jurisdictions facilitate organised crime, corruption, and tax evasion by making their owners anonymous. Setting up shell companies in multiple jurisdictions can make investigations even more complicated and challenging, as it allows people to pick and choose laws from different countries to suit their purposes. A study by the World Bank found that 70% of grand corruption cases studied involved the use of anonymously owned companies.

Shell companies in these jurisdictions facilitate organised crime, corruption, and tax evasion by making their owners anonymous.